Make an

impact today

Support our mission by contributing to our Enterprise Zone Project

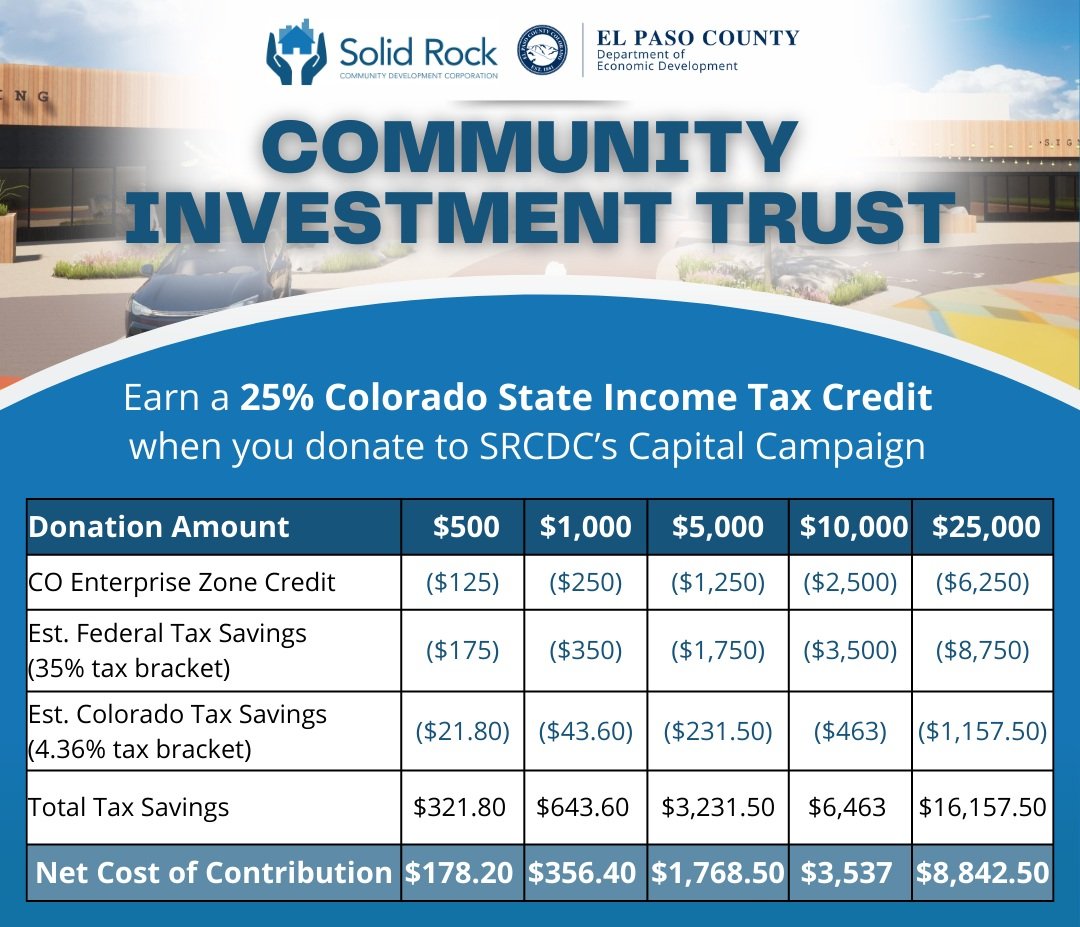

Solid Rock CDC is proud to be a designated Pikes Peak Enterprise Zone Tax Credit Organization. This program offers Colorado taxpayers an opportunity to make a bigger impact through their charitable donations by providing a 25% state income tax credit for qualifying contributions. By giving to Solid Rock CDC’s capital campaign you can maximize your giving potential while enjoying additional tax benefits.

Maximize Your Contribution!

For more details, view our step by step guide.

SRCDC EZ TAX CREDIT GUIDE

Questions? Call us at (719) 266-2299

You may give through check to make your donation:

Make your check payable to: Pikes Peak Enterprise Zone

In the memo line, write: Solid Rock CDC

Mail your check to our business office at:

2510 Arlington Drive

Colorado Springs, CO 80910

For first-time EZ donors:

If you have not previously made a donation to Solid Rock CDC through the Enterprise Zone (EZ), please include one of the following with your donation:

The last four digits of the primary taxpayer's Social Security number, or

The full business EIN (Employer Identification Number).

FAQs

-

An Enterprise Zone (EZ) in Colorado is a designated area with economic challenges that offers tax incentives to businesses and tax credits to donors. The primary goal of the Enterprise Zone (EZ) Contribution Project Program is to create or preserve an environment that will help attract, expand, and retain employers in the EZ.

-

Donors are eligible to receive a 25% tax credit with a minimum donation of $250 annually in addition to regular tax benefits for charitable gifts.

-

You may give through check.

To make your donation:

Make your check payable to: Pikes Peak Enterprise Zone

In the memo line, write: Solid Rock CDC

Mail your check to our business office at:

2510 Arlington Drive

Colorado Springs, CO 80910

For first-time EZ donors:

If you have not previously made a donation to Solid Rock CDC through the Enterprise Zone (EZ), please include one of the following with your donation:The last four digits of the primary taxpayer's Social Security number, or

The full business EIN (Employer Identification Number).

-

After We Receive Your Donation:

The Solid Rock CDC staff will process your donation with the Enterprise Zone Administrator.

The Enterprise Zone Administrator will issue and mail you a “Certification of Qualified Enterprise Zone Contribution” (DR0075) form. Please allow 4-6 weeks from the date of your donation for this to arrive.

Use this form to claim your state income tax credit when filing your taxes.

-

December 31, 2024